Share Budgeting Advice and Templates: Managing Your Finances with Ease

Budgeting is an essential financial tool that can help you take control of your money and achieve your financial goals. When it comes to managing expenses with others, such as family members, roommates, or business partners, sharing a budget is an effective way to ensure everyone stays on track and avoids financial conflicts.

In this blog, we'll provide you with valuable share budgeting advice and share budget templates to simplify the process. Whether you're sharing expenses with family, friends, or colleagues, these tips and templates will help you manage your finances collaboratively and successfully.

Why Share a Budget?

Sharing a budget can benefit you in several ways:

- Transparency: Sharing a budget promotes financial transparency among all parties involved. It ensures that everyone knows where the money is going, reducing misunderstandings and conflicts.

- Accountability: When you have to report your expenses to others, you're more likely to stick to your budget. Accountability encourages responsible spending.

- Efficiency: Sharing a budget allows you to pool resources, making it easier to save for common goals or manage shared expenses like rent, utilities, or groceries.

Share Budgeting Advice

1. Communicate Openly: Effective communication is the cornerstone of successful shared budgeting. Discuss financial goals, spending limits, and expectations with all parties involved.

2. Choose the Right Tools: Decide whether you'll use digital tools or traditional methods like spreadsheets and paper records. Many apps and online tools are available for collaborative budgeting.

3. Create a Shared Expense List: List all shared expenses, such as rent, utilities, groceries, and entertainment. Be specific about who is responsible for what.

4. Set Clear Contribution Guidelines: Determine each person's share of the expenses and decide on a due date for contributions. Make sure everyone understands their financial responsibilities.

5. Regularly Update the Budget: Keep the budget up-to-date by tracking expenses and contributions regularly. This prevents surprises and helps you adjust your spending if necessary.

6. Emergency Funds: Consider setting up an emergency fund that all parties contribute to. This can cover unexpected shared expenses without straining individual budgets.

7. Review and Adjust: Periodically review your shared budget to assess your progress and make adjustments as needed. Life circumstances and financial goals can change.

Share Budget Templates

To make shared budgeting easier, we've provided some templates you can use. Customize these templates according to your specific needs:

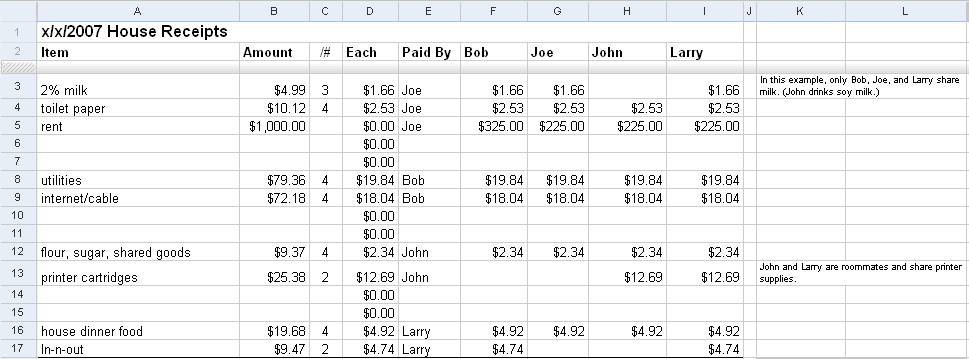

1. Shared Expense Tracker

This spreadsheet template allows you to track shared expenses, contributions, and outstanding balances. It's ideal for households or roommates.

2. Joint Venture Budget

If you're sharing expenses for a business project or investment, this template helps you manage costs, revenues, and profits.

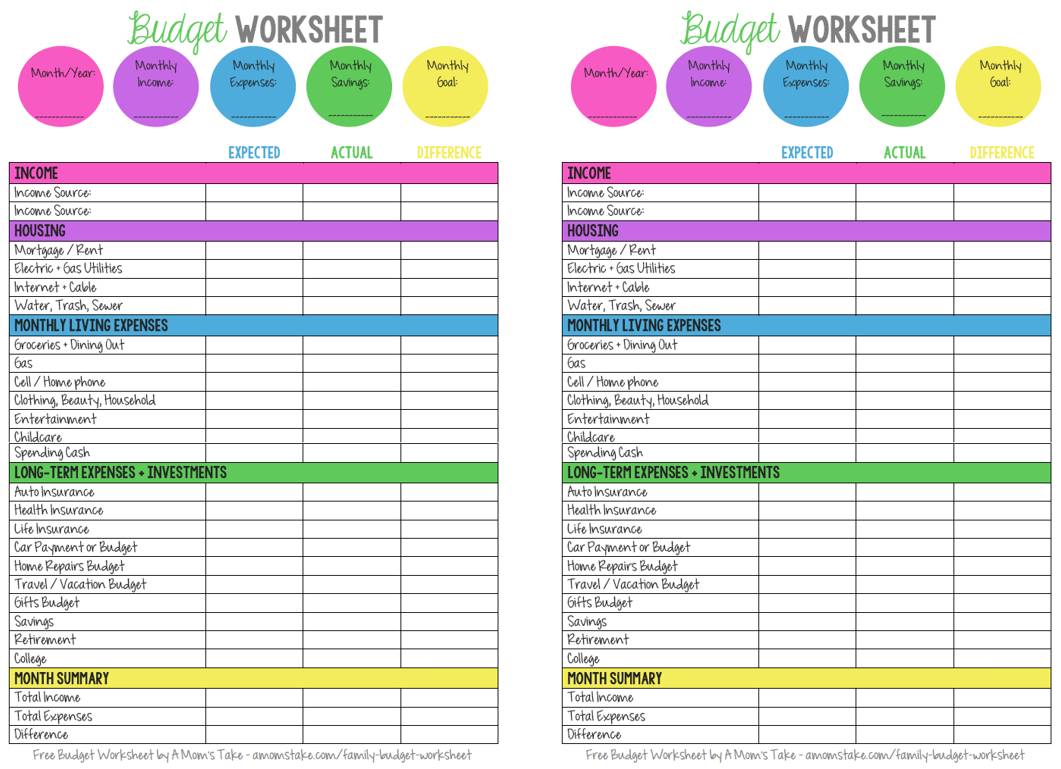

3. Family Budget

For families, this template includes sections for various expense categories, including childcare, groceries, and entertainment.

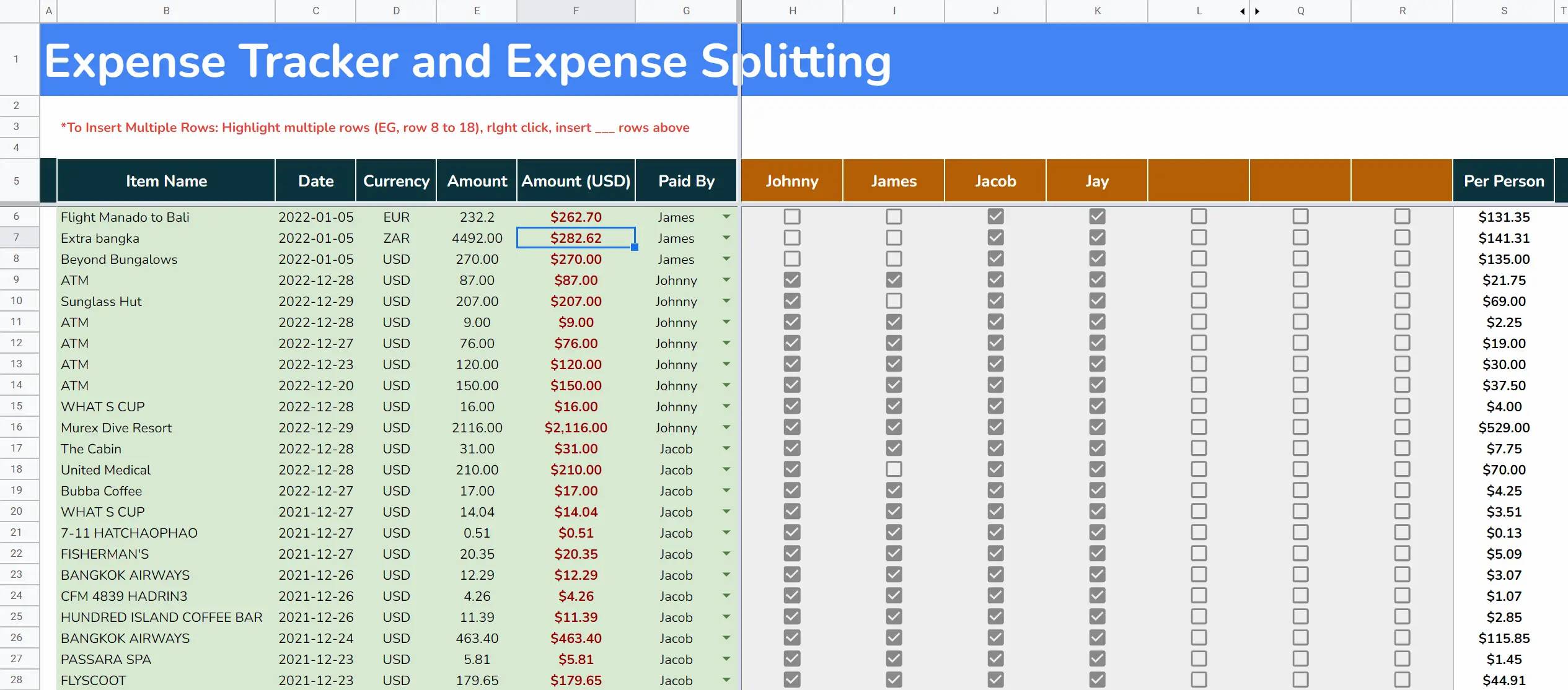

4. Travel Expense Splitter

When traveling with friends, use this template to track expenses and fairly split costs.

Conclusion

Sharing a budget can be a highly effective way to manage finances collaboratively and ensure that everyone involved stays on the same page. By following the share budgeting advice and utilizing the provided templates, you can streamline the process, reduce financial conflicts, and work towards your financial goals as a team. Remember, communication and consistency are key to successful shared budgeting.

Related Posts

© 2025 Invastor. All Rights Reserved

User Comments