Stocks, Bonds, and More: Understanding Investment Options

Investing is an important aspect of financial planning, and understanding different investment options is crucial for making informed decisions. Stocks, bonds, and other investment vehicles offer various opportunities for individuals to grow their wealth over time.

Stocks

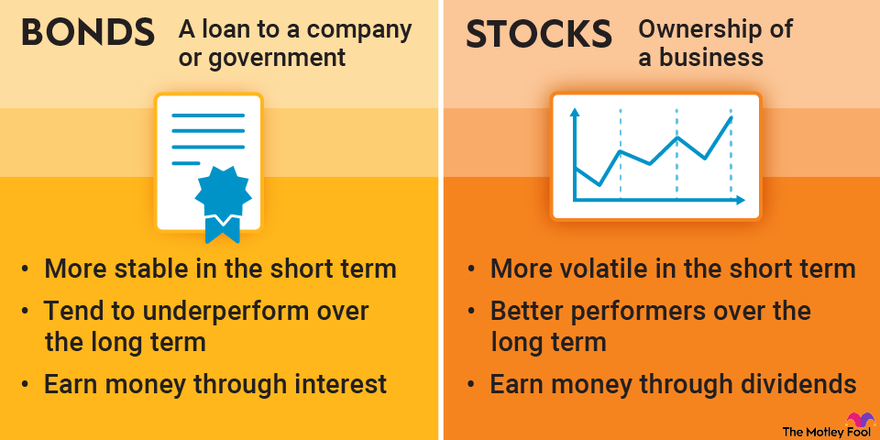

Stocks represent ownership in a company. When you buy a stock, you become a shareholder and have a claim on the company's assets and earnings. Stocks can be categorized into two types:

- Common Stocks: These stocks give shareholders voting rights and the potential for dividends. However, common stockholders have a lower claim on the company's assets compared to bondholders and preferred stockholders.

- Preferred Stocks: Preferred stockholders have a higher claim on the company's assets and earnings compared to common stockholders. They receive dividends before common stockholders and have a fixed dividend rate.

For example, if you buy shares of Apple Inc., you become a part-owner of the company and can benefit from its growth and profitability.

Bonds

Bonds are debt securities issued by governments, municipalities, and corporations to raise capital. When you buy a bond, you are essentially lending money to the issuer in exchange for periodic interest payments and the return of the principal amount at maturity.

Bonds can be classified into different types:

- Government Bonds: These are issued by governments to finance their operations and projects. Examples include U.S. Treasury bonds, which are backed by the U.S. government.

- Corporate Bonds: These are issued by corporations to raise capital for various purposes. Corporate bonds offer higher interest rates compared to government bonds but also carry higher risks.

- Municipal Bonds: These are issued by state and local governments to fund public infrastructure projects. Municipal bonds offer tax advantages to investors.

For instance, if you invest in U.S. Treasury bonds, you are lending money to the U.S. government and can expect regular interest payments and the return of your principal when the bond matures.

Mutual Funds

Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. They are managed by professional fund managers who make investment decisions on behalf of the investors.

Mutual funds offer several advantages, including diversification, professional management, and liquidity. They come in various types, such as equity funds, bond funds, index funds, and sector-specific funds.

For example, if you invest in an S&P 500 index fund, your money will be spread across the stocks of all the companies in the S&P 500 index, providing broad market exposure.

References:

1. Investopedia - https://www.investopedia.com/investing/basics/

2. U.S. Securities and Exchange Commission - https://www.sec.gov/reportspubs/investor-publications/investorpubsbegfinstmtguidehtm.html

It's important to note that investment options carry risks, and it's advisable to consult with a financial advisor before making any investment decisions.

Related Posts

© 2025 Invastor. All Rights Reserved

User Comments