How does Billerica's property tax rate compare to nearby towns?

When comparing Billerica's property tax rate to nearby towns, it is important to consider the specific tax rates and the overall tax burden on residents. While I couldn't find specific data on Billerica's property tax rate, I can provide a general comparison based on nearby towns in Massachusetts.

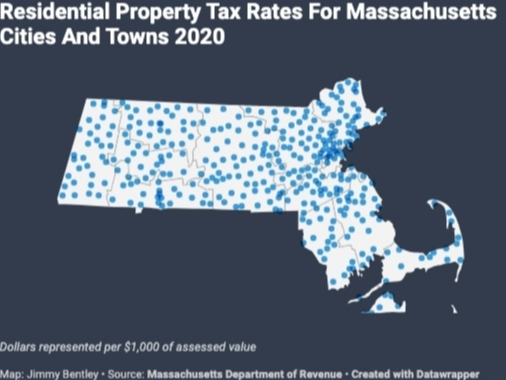

One way to compare property tax rates is by looking at the average tax rate in the region. For example, according to data from the Massachusetts Department of Revenue, the average residential property tax rate in Middlesex County, where Billerica is located, was 1.14% in 2020.

Now let's compare this to some nearby towns:

- Chelmsford: Chelmsford had a residential property tax rate of 1.28% in 2020, slightly higher than the county average.

- Lowell: Lowell had a residential property tax rate of 1.19% in 2020, slightly lower than the county average.

- Tewksbury: Tewksbury had a residential property tax rate of 1.34% in 2020, higher than both the county average and Billerica's neighboring towns.

It's important to note that property tax rates can vary based on factors such as local government budgets and property assessments. Therefore, it's always a good idea to check the most up-to-date information from official sources such as the town's website or the local tax assessor's office.

References:

- Massachusetts Department of Revenue - Property Tax Rates: https://www.mass.gov/info-details/massachusetts-department-of-revenue-dor-property-tax-information

Related Posts

© 2025 Invastor. All Rights Reserved

User Comments